Page 1

Loading page image...

Page 2

Loading page image...

Page 3

Loading page image...

Page 4

Loading page image...

Page 5

Loading page image...

Page 6

Loading page image...

Page 7

Loading page image...

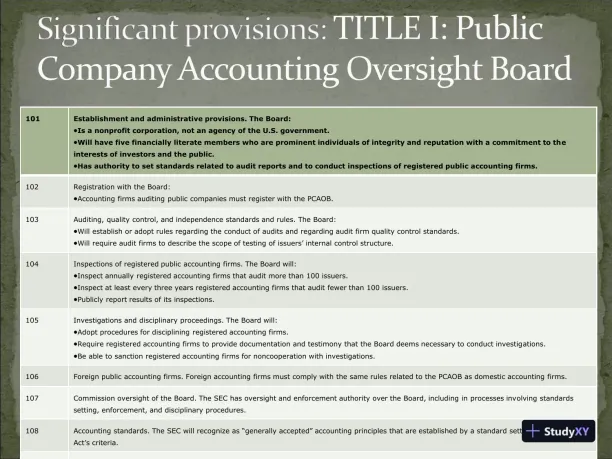

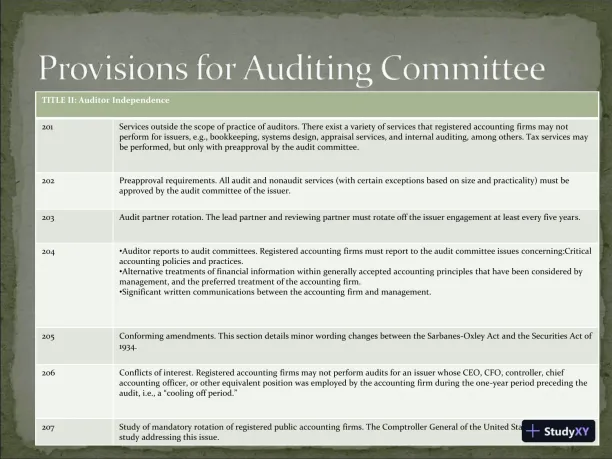

Gain a deep understanding of the Sarbanes-Oxley Act through this Project Presentation.

Loading page image...

Loading page image...

Loading page image...

Loading page image...

Loading page image...

Loading page image...

Loading page image...

This document has 22 pages. Sign in to access the full document!