Page 1

Loading page image...

Page 2

Loading page image...

Page 3

Loading page image...

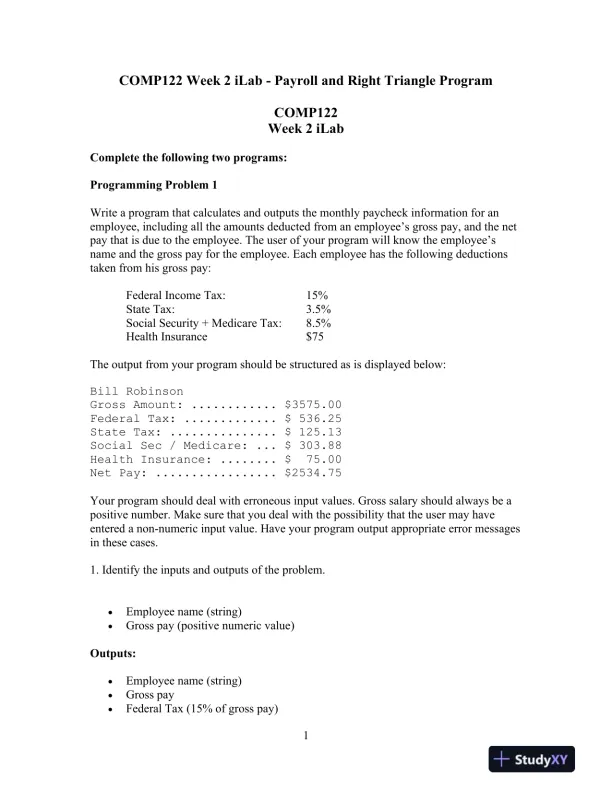

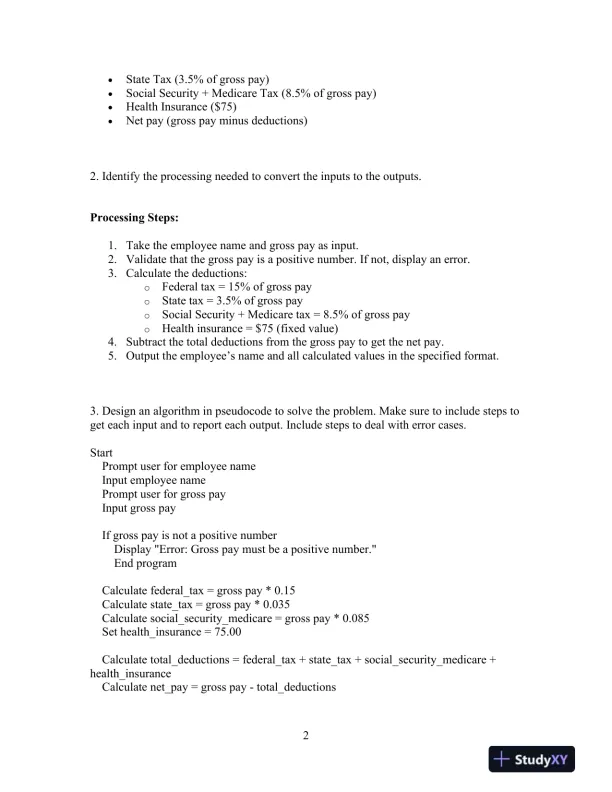

A week 2 iLab focusing on creating a payroll program and solving right triangle problems using C++.

Loading page image...

Loading page image...

Loading page image...

This document has 9 pages. Sign in to access the full document!